Contrasts in the hydrogen policy of European countries

The hydrogen policy of the various countries in Europe, the assessment of future demand and supply, prices, are the subject of the report "Contrasting European hydrogen routes: Analysis of different approaches in key markets". The report was prepared by the Oxford Institute for Energy Research (OIES) and the Institute for Economics and Energy in Cologne (EWI). It examines the hydrogen policy of six European countries - Britain, Germany, Spain, Italy, the Netherlands and France. This is low-carbon hydrogen in the context of the decarbonisation of the economy. It is noted that despite the similar ambitions of the countries, the approaches are different and tailored depending on the region and the size of the natural gas market. "While all six European countries in question have ambitions to increase the production and use of low-carbon hydrogen, there are clear differences between each country's political factors," the report said.

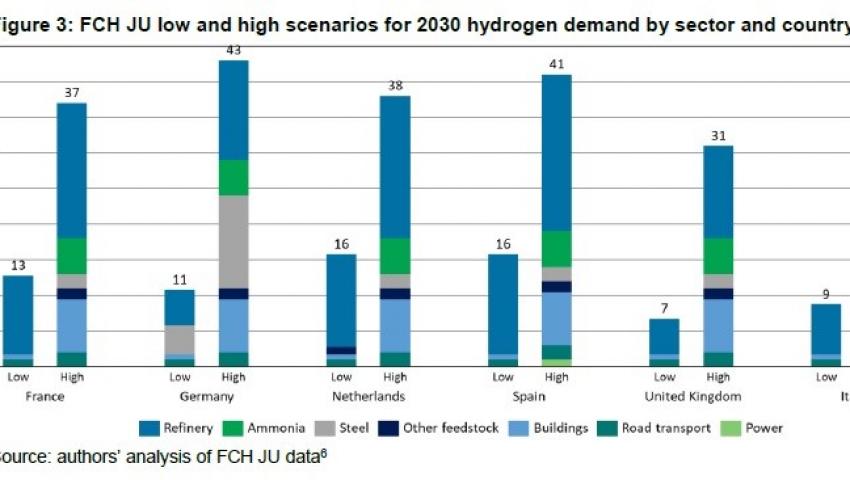

The authors of the document note that "there is a wide range of forecasts for each of the countries under consideration" - not only long-term until 2050, but also short-term. The graph presented by the authors of the two institutes shows the forecasts for the demand for pure (blue and green) hydrogen in 2030 and, as can be seen, they are quite streamlined. This uncertainty is also explained by the fact that to date no one has been able to say at what speed one or another sector will move to the so-called. "Pure hydrogen". "There is also significant uncertainty about the level of demand for hydrogen for electricity generation," the authors note.

The report notes that green hydrogen is an obvious priority for Germany, Spain and Italy. The UK and the Netherlands are ready to work with a son, as governments and the public are more in favor of carbon capture and storage technology. France stands out - it plans to produce hydrogen with the help of nuclear electricity. "In line with the EU's hydrogen strategy, all countries see a significant long-term role for green hydrogen produced by electrolysis based on the use of renewable electricity. The United Kingdom and, to a lesser extent, the Netherlands are considering the use of blue hydrogen through natural gas as a feedstock and carbon capture and storage as a temporary measure. However, Germany, Spain and Italy do not see any role for blue hydrogen, although it remains questionable whether this policy position will be eased as the challenges of large-scale green hydrogen production become apparent. France is unique in Europe in that it relies heavily on nuclear power generation (although many of its nuclear power plants are nearing the end of their lives).

The authors believe that it is better to postpone large-scale investments in green hydrogen. It would be logical to “initially focus on blue hydrogen until around 2030, when large-scale renewable energy must emerge to justify significant investment in electrolysis.

"Germany seems to have the strongest emphasis on technological leadership, while France, the Netherlands and the United Kingdom also see it as an important element in their approaches to low-carbon hydrogen," the authors write.

"As far as imports / exports are concerned, Germany is adamant that it does not expect to be able to meet all its domestic demand for hydrogen, so low-carbon imports will play an important role. At the other extreme is Spain, which has greater potential for large amounts of cheap solar energy and which is seen as a potential significant exporter of hydrogen. Italy sees itself as a potential center for imports into Europe from North Africa, although it is not clear at this stage to what extent it predicts that there will be a surplus of hydrogen so that there will be further exports to the north to the rest of Europe. The United Kingdom, with a rich offshore wind potential and more favorable to CCS, sees limited potential for exporting excess hydrogen to neighboring countries.

The report also notes that based on a comparison of supply and demand forecasts, ultimately by 2030 the total supply of low-carbon hydrogen (blue plus green) will be lower than existing industrial production of gray hydrogen. That is, the supply of pure hydrogen is still not limited by demand.

"Our conclusion, however, is that there is limited value that can be gained by focusing unnecessarily on such demand forecasts.

It is more important to decarbonize existing hydrogen production first, thus increasing the scale and reducing the cost of producing low-carbon hydrogen. It is also important to explore the potential for new hydrogen demand in sectors where a significant new investment cycle will take place in the near future, for example in the steel industry in Germany. In parallel, research and development must continue to assess the use of hydrogen in other sectors, in particular to assess the extent and conditions under which hydrogen can provide a cost-effective path to decarbonisation in each sector, compared to alternatives such as electrification. " , the authors of the report believe. They also draw attention to the need for earlier indications for decarbonization of buildings.

"It is also important to develop policy measures to stimulate low-carbon hydrogen production."

The authors of the report are to some extent pessimistic about the future value (LCOH) of green hydrogen. Only in 2050 can it fall and be in the range of 2-3 euros per kilogram, at least according to the quoted data of EWI. There are also recommendations regarding tax policy.

In general, the clarity regarding the further development of the "hydrogen economy" is still low, the authors conclude. It is expected that there will be more clarity in the current 2021, when "additional EU directives" and the political positions of individual countries on hydrogen issues are expected.