Turkey, Bulgaria offer spot capacity amid uncertain Ukraine transit

Author: Aura Sabadus,icis.com

BUCHAREST (ICIS)--Turkish and Bulgarian transmission system operators are expected to allocate some capacity on the Trans-Balkan pipeline on a short-term rather than annual basis amid uncertainty over a long-term transit contract negotiated between Ukraine and Russia.

In a note posted on its website on Thursday, the Turkish regulator EPDK said capacity on the pipeline which had been used to transport Russian gas to the market via Ukraine, Moldova, Romania and Bulgaria would be allocated from Bulgaria into Turkey only on a quarterly and monthly basis.

A market source said Russain producer Gazprom would also have to decide the allocation protocol for the capacity. Most of the pipeline capacity is still currently booked under long-term contracts which expire between 2021-2043.

Any spare capacity would have to be allocated based on a protocol agreed with Gazprom, as the seller of gas to the Turkish incumbent BOTAS and independent importers.

Capacity nominations were due to be made in November, but the deadline has now been pushed forward to December.

It is not clear how much capacity would be allocated in this direction and according to what methodology.

As a non-EU state, Turkey is not obliged to auction cross-border capacity on the open regional RBP platform. This means that it is up to the regulator and the transmission system operator, BOTAS, to decide how this capacity is allocated.

Sources said one option may be to allocate it on a first-come-first-served basis.

Nevertheless, Turkish market participants point out that Turkey and Bulgaria would first have to sign an interconnection agreement before any capacity is allocated. So far there are no indications that such a document has been signed.

DELIVERY POINTS

The source also noted that Turkish counterparties and Gazprom would have to decide on what volumes and delivery points for supplies would be chosen from 1 January 2020.

Up until now, Turkish companies had been off-taking Russian gas shipped through the Trans-Balkan pipeline via Ukraine.

However, as Ukraine’s long-term transit contract with Gazprom expires on 31 December 2019, and Russia intends to divert volumes to the new TurkStream corridor via Turkey, all terms embedded in contracts which depend on this transit are up for review.

Given the uncertainty, the Turkish regulator has now decided that capacity would only be allocated on a short-term basis until there is more clarity regarding the long-term supply contracts in Turkey, the Ukraine-Russia transit contract as well as the transit switchover from the Trans-Balkan pipeline to TurkStream.

Once TurkStream is operational, potentially next year, flows would need to be reversed so that gas would flow from Turkey into Bulgaria.

TURKEY-BULGARIA

In anticipation of the TurkStream commissioning, the Bulgarian TSO, Bulgartransgaz, announced on 28 October that it would auction firm unbundled capacity in the direction Turkey-Bulgaria for Q1 ’20, Q2 ’20 and Q3 ’20.

The capacity will be for Malkoclar-Strandja 2, a new exit point linking the Russian TurkStream2 pipeline to the Bulgarian transmission system.

The TSO did not publish offered capacity, but the regional RBP auctions platform indicates that the capacity offered would be 288GWh/day/quarter in Q1, Q2 and Q3 2020.

The starting tariff for capacity in Q1 ’20 would be Bulgarian Lev 0.065/KWh/day/quarter (€0.033/KWh/day/quarter) in Q1 ’20 and Bulgarian Lev 0.0359/KWh/day/quarter in Q2 and Q3 ’20.

The capacities are in line with those allocated as part of an open season held by Bulgartransgaz for the Turkish-Bulgarian cross-border point.

Earlier in February 2019, Bulgartransgaz allocated a total of 289.5GWh/day/year of capacity on the Malkoclar-Strandja interconnection point on the Turkish-Bulgarian border for 2020 and 2021. The capacity is set to increase to 511GWh/day/year from 1 January 2022 for a period of 18 years.

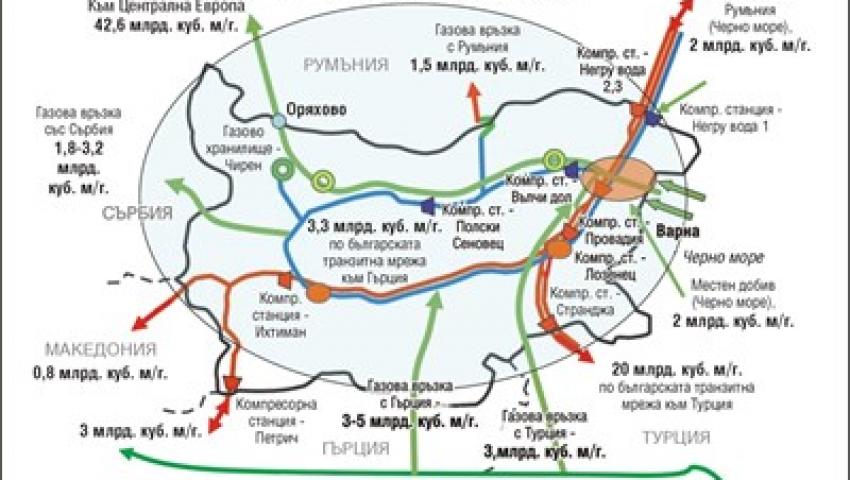

TurkStream2 is one two 15.75billion cubic metres/year pipelines that will link Russia to Turkey via the Black Sea. TurkSTream1 will feed the Turkish market and is expected to be commissioned at the beginning of 2020, while TurkStream2 is expected to carry natural gas into Bulgaria, Serbia, Hungary. The commissioning date is yet unknown.